7 Trends Daily

Stay updated with the latest insights and trends across various sectors.

Whole Life Insurance: Your Guaranteed Ticket to Financial Peace

Unlock financial peace with Whole Life Insurance—your guaranteed safety net for life’s uncertainties! Discover how it works today!

Understanding Whole Life Insurance: Key Benefits and Features

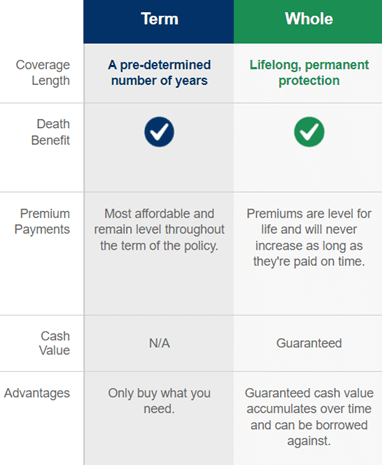

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as the premiums are paid. This financial product not only offers a death benefit to beneficiaries but also includes a savings component known as cash value. As the policyholder makes premium payments, a portion of these payments accumulates as cash value, which grows at a guaranteed rate. Over time, this cash value can be borrowed against or withdrawn, making it a valuable financial asset. Understanding the key benefits and features of whole life insurance is crucial for individuals seeking long-term financial security.

One of the main advantages of whole life insurance is its predictable nature. Unlike term life insurance, which only provides coverage for a specified period, whole life insurance guarantees lifetime protection. Additionally, the cash value grows tax-deferred, meaning policyholders won’t pay taxes on the growth until they withdraw it. Furthermore, premiums for whole life policies are typically fixed, offering stability in financial planning. Other essential features include dividends that some policies may pay, which can be used to reduce premiums or increase the overall death benefit. By understanding these elements, individuals can make informed decisions about integrating whole life insurance into their financial strategy.

Is Whole Life Insurance Right for You? Essential Questions to Consider

Deciding whether whole life insurance is right for you involves careful consideration of your financial goals, lifestyle, and family needs. Begin by evaluating your current financial situation and future plans. Ask yourself essential questions such as:

- What are my long-term financial goals?

- Do I need coverage for my entire life, or is temporary coverage sufficient?

- How much can I afford to pay in premiums each month?

Another aspect to consider is the investment component of whole life insurance. Unlike term insurance, whole life policies provide a cash value that grows over time. Consider the following:

- How important is the cash value aspect to my overall financial strategy?

- Am I comfortable with the lower returns compared to other investment options?

- Will the policy provide enough financial security for my beneficiaries?

The Long-Term Value of Whole Life Insurance: A Path to Financial Security

Whole life insurance is not just a policy for covering funeral expenses; it represents a long-term financial strategy that can offer significant value over the years. This type of insurance provides lifelong coverage, meaning that your beneficiaries will receive a death benefit regardless of when you pass away. Additionally, a portion of the premiums you pay accumulates as cash value, which grows at a guaranteed rate. This cash value can serve as a financial resource during your lifetime, offering options such as taking out loans or even funding retirement. Therefore, investing in whole life insurance can be viewed as a foundation for financial security that transcends the traditional scope of life insurance.

Moreover, the long-term value of whole life insurance extends beyond just financial benefits. It also acts as a mechanism for wealth transfer. As the cash value grows, policyholders can utilize it to supplement their retirement income or provide financial assistance to heirs, effectively facilitating a lasting legacy. The sense of security from knowing your family will have financial support can be invaluable. In a world filled with uncertainties, turning to whole life insurance ensures that you are not only investing in your future but also protecting the ones you love, paving a path to intergenerational financial security.