7 Trends Daily

Stay updated with the latest insights and trends across various sectors.

Term Life Insurance: Because You Can't Take It With You

Secure your loved ones' future with term life insurance—find out why it's the smartest investment you can make today!

Understanding Term Life Insurance: Key Benefits and Features

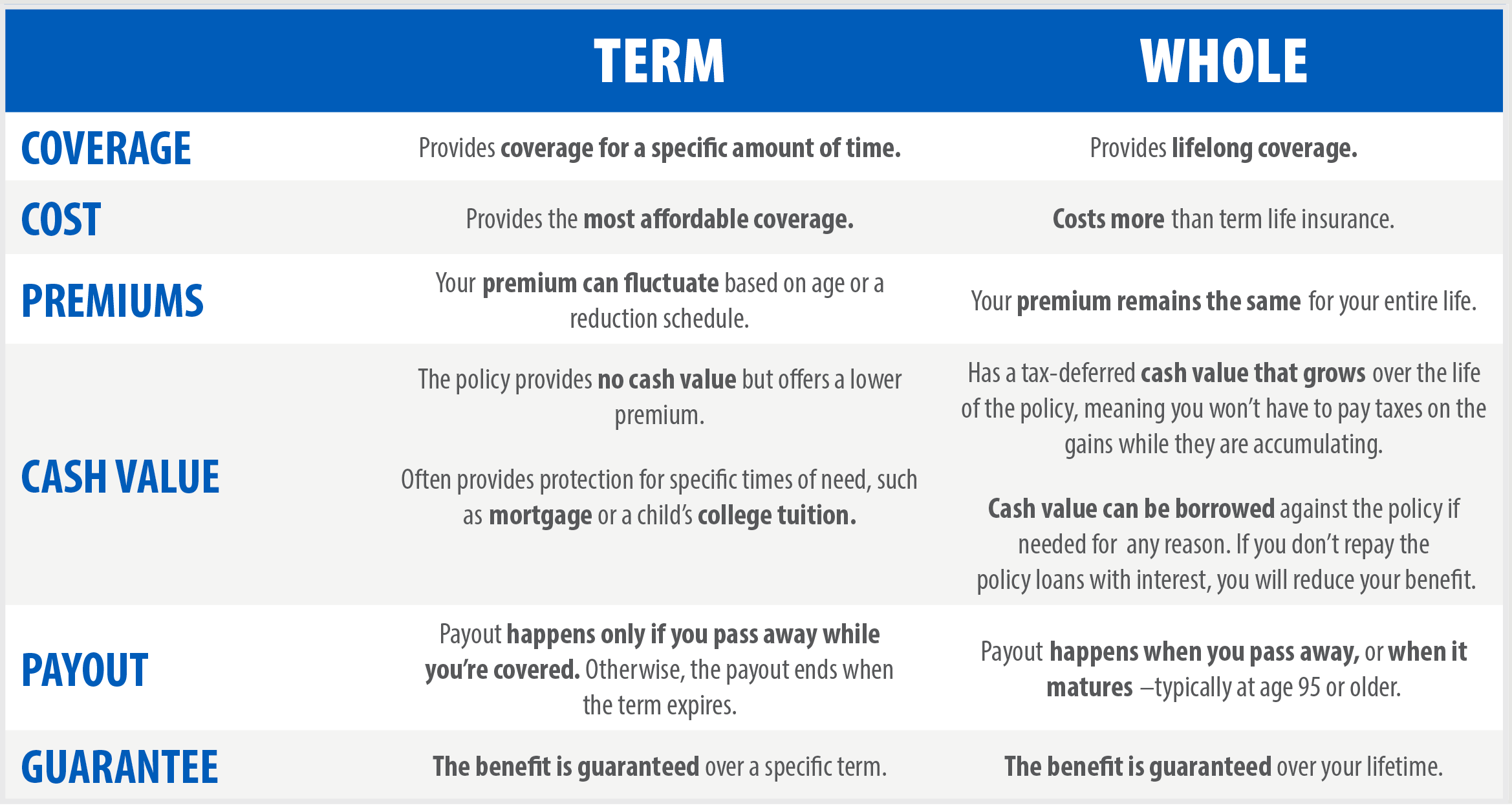

Term life insurance is a popular choice for individuals looking for affordable coverage over a specified period. Unlike whole life insurance, which provides lifetime coverage, term life insurance is designed to last for a set number of years, typically ranging from 10 to 30 years. This type of policy offers several key benefits, including the ability to obtain a higher coverage amount at a lower premium. For instance, many families choose term life to ensure financial security during critical phases, such as raising children or paying off a mortgage.

One notable feature of term life insurance is its flexibility. Policyholders can often choose the term length and adjust coverage amounts as needed. Additionally, many insurers offer conversion options that allow policyholders to switch to permanent life insurance without undergoing additional medical underwriting. This adaptability makes term life insurance an excellent foundation in a comprehensive financial plan, providing essential life coverage while allowing individuals to reassess their insurance needs as their circumstances evolve.

Is Term Life Insurance Right for You? 5 Questions to Consider

When contemplating whether term life insurance is the right choice for you, it's essential to assess your individual needs and financial responsibilities. Start by evaluating your current life situation: Are you the primary breadwinner in your family? Do you have dependents who rely on your income? Term life insurance can provide financial security for your loved ones in the event of your passing, ensuring they can cover essential expenses like mortgage payments, education costs, and everyday living expenses.

Next, consider how long you will require coverage. Term life insurance is typically purchased for a specific period, such as 10, 20, or 30 years. Ask yourself if you have debts or financial obligations that will last for that duration. Additionally, evaluate your budget: is the premium affordable for you? Lastly, think about your long-term goals. If you're looking for a simple, straightforward life insurance option without the lengthy investment component of permanent policies, term life may be the ideal solution for you.

How Term Life Insurance Can Provide Financial Security for Your Loved Ones

Term life insurance is an essential financial tool that can provide significant peace of mind for you and your family. This type of insurance offers coverage for a specified period, typically ranging from 10 to 30 years, ensuring that your loved ones are financially protected in the event of your untimely passing. The death benefit paid out by the policy can help cover daily living expenses, mortgage payments, and college tuition, allowing your family to maintain their quality of life even in your absence.

Moreover, term life insurance is often more affordable than whole life policies, making it accessible for families on a budget. With premiums that can fit within most financial plans, this coverage is a smart way to safeguard your family's future. By selecting the right term and coverage amount, you can ensure that your loved ones have the necessary resources to navigate their financial responsibilities without added stress during a difficult time.