7 Trends Daily

Stay updated with the latest insights and trends across various sectors.

Riding the Crypto Rollercoaster: How Market Volatility Shapes Your Investment Journey

Experience the wild ride of crypto investing! Discover how market volatility can shape your financial future and boost your returns.

Understanding Market Volatility: Key Factors That Influence Cryptocurrency Prices

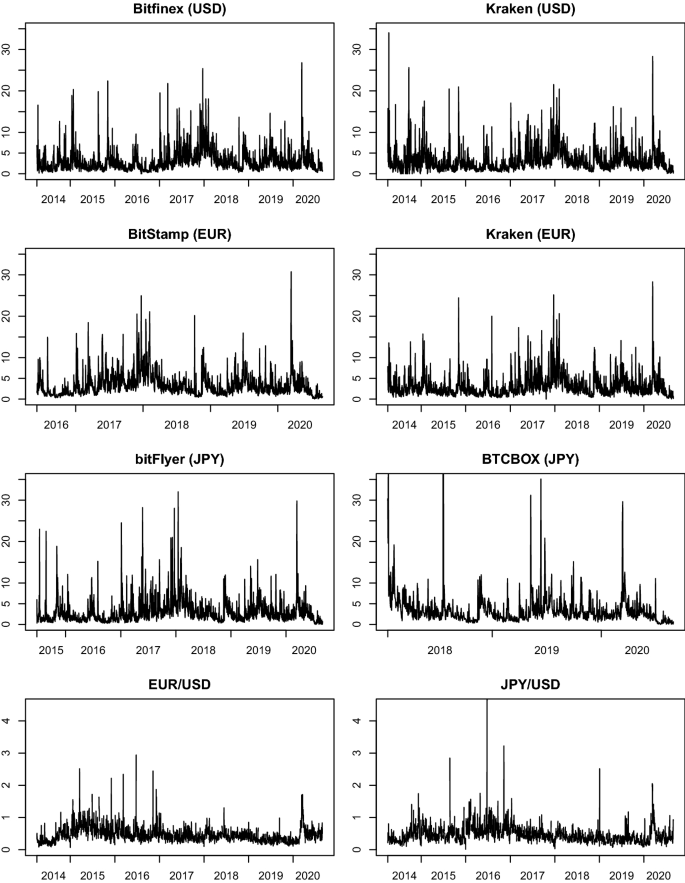

Understanding market volatility in the cryptocurrency space is crucial for both seasoned investors and newcomers alike. Prices often fluctuate wildly, influenced by a variety of factors that can change within moments. Key elements include supply and demand dynamics, regulatory news, technological advancements, and market sentiment. For instance, if a major exchange announces new trading features for a cryptocurrency, demand may surge, driving prices up. Conversely, negative news, such as potential regulatory crackdowns, can lead to panic selling, exposing the high volatility intrinsic to crypto markets.

Another critical factor to consider is market manipulation. In the relatively young and less regulated cryptocurrency markets, large stakeholders, often referred to as 'whales,' can significantly impact prices by making substantial trades. Additionally, social media and news outlets play a pivotal role in shaping public perception, which can lead to rapid price changes. By understanding these factors, investors can better navigate the unpredictable waters of cryptocurrency trading and make more informed decisions. Market volatility is not just a challenge; it also presents opportunities for those who are prepared.

Counter-Strike is a popular tactical first-person shooter game that pits teams of terrorists against counter-terrorists in various mission objectives. Players can enjoy a variety of gameplay modes, including bomb defusal and hostage rescue. To enhance your gaming experience, check out the cloudbet promo code, which can offer exciting bonuses.

Top Strategies for Navigating the Ups and Downs of Crypto Investments

Investing in cryptocurrency can be a rollercoaster ride, with market fluctuations that can either lead to significant gains or substantial losses. To navigate these ups and downs, it is crucial to adopt a well-defined strategy. One effective approach is to conduct thorough research and develop a diversified portfolio. By spreading your investments across different cryptocurrencies and asset classes, you can mitigate risks associated with market volatility. Additionally, staying updated with the latest news and trends in the crypto space will help you make informed decisions and react promptly to changing market conditions.

Another essential strategy for managing crypto investments is to implement clear buy and sell targets. Establishing predefined price points for both entering and exiting a trade can prevent emotional decision-making during periods of high volatility. Furthermore, incorporating dollar-cost averaging into your investment approach can also be beneficial. This strategy involves investing a fixed amount of money at regular intervals, regardless of the asset's price. Over time, this can help reduce the impact of market fluctuations and build a more stable investment portfolio.

How to Manage Emotions During Market Swings: A Guide for Investors

Investing in the stock market can be a rollercoaster ride of emotions, especially during turbulent market swings. Managing emotions is crucial for making informed decisions. One effective strategy is to establish a clear investment plan before entering the market. This plan should include your financial goals, risk tolerance, and criteria for buying and selling assets. By having a well-defined strategy, you can reduce the influence of fear and greed on your decisions.

Another key approach to managing emotions during market fluctuations is to practice mindfulness and self-awareness. Techniques like meditation and journaling can help investors reflect on their thoughts and feelings during market moves. Additionally, consider diversifying your portfolio to mitigate risks and lessen anxiety during downturns. Remember, it’s essential to stay informed, yet not overwhelmed by market news. Focus on the long-term view of your investments rather than reacting impulsively to short-term changes.